What is Blockchain Technology? A Step-by-Step Guide For Beginners

Is Blockchain Technology the New Internet?

The

blockchain is an undeniably ingenious invention – the brainchild of a

person or group of people known by the pseudonym, Satoshi Nakamoto. But

since then, it has evolved into something greater, and the main question

every single person is asking is: What is Blockchain?

By allowing

digital information to be distributed but not copied, blockchain

technology created the backbone of a new type of internet. Originally

devised for the

digital currency,

Bitcoin, (

Buy Bitcoin) the tech community has now found other potential uses for the technology.

In

thisguide, we are going to explain to you what the blockchain

technology is, and what its properties are that make it so unique. So,

we hope you enjoy this, What Is Blockchain Guide. And if you already

know what blockchain is and want to become a blockchain developer please

check out our in-depth

blockchain tutorial and create your very first blockchain.

Understanding Blockchain Technology

“The

blockchain is an incorruptible digital ledger of economic transactions

that can be programmed to record not just financial transactions but

virtually everything of value.” – Don & Alex Tapscott, authors

Blockchain Revolution (2016).

“The

blockchain is an incorruptible digital ledger of economic transactions

that can be programmed to record not just financial transactions but

virtually everything of value.” – Don & Alex Tapscott, authors

Blockchain Revolution (2016).

A blockchain is, in the

simplest of terms, a time-stamped series of immutable record of data

that is managed by cluster of computers not owned by any single entity.

Each of these blocks of data (i.e. block) are secured and bound to each

other using cryptographic principles (i.e. chain).

So, what is so special about it and why are we saying that it has industry disrupting capabilities?

The

blockchain network has no central authority — it is the very definition

of a democratized system. Since it is a shared and immutable ledger,

the information in it is open for anyone and everyone to see. Hence,

anything that is built on the blockchain is by its very nature

transparent and everyone involved is accountable for their actions.

Blockchain Explained

A blockchain carries

no transaction cost.

(An infrastructure cost yes, but no transaction cost.) The blockchain

is a simple yet ingenious way of passing information from A to B in a

fully automated and safe manner. One party to a transaction initiates

the process by creating a block. This block is verified by thousands,

perhaps millions of computers distributed around the net. The verified

block is added to a chain, which is stored across the net, creating not

just a unique record, but a unique record with a unique history.

Falsifying a single record would mean falsifying the entire chain in

millions of instances. That is virtually impossible. Bitcoin uses this

model for monetary transactions, but it can be deployed in many others

ways.

Think of a railway company. We

buy tickets

on an app or the web. The credit card company takes a cut for

processing the transaction. With blockchain, not only can the railway

operator save on credit card processing fees, it can move the entire

ticketing process to the blockchain. The two parties in the transaction

are the railway company and the passenger. The ticket is a block, which

will be added to a ticket blockchain. Just as a monetary transaction on

blockchain is a unique, independently verifiable and unfalsifiable

record (like Bitcoin), so can your ticket be. Incidentally, the final

ticket blockchain is also a record of all transactions for, say, a

certain train route, or even the entire train network, comprising every

ticket ever sold, every journey ever taken.

But the key here is this: it’s free. Not only can the blockchain transfer and store money,

but it can also replace all processes and business models which rely on charging a small fee for a transaction. Or any other transaction between two parties.

Here

is another example. The gig economy hub Fivver charges 0.5 dollars on a

5 transaction between individuals buying and selling services. Using

blockchain technology the transaction is free. Ergo, Fivver will cease

to exist. So will auction houses and any other business entity based on

the market-maker principle.

Even recent entrants like

Uber and AirBnB

are threatened by blockchain technology. All you need to do is encode

the transactional information for a car ride or an overnight stay, and

again you have a perfectly safe way that disrupts the business model of

the companies which have just begun to challenge the traditional

economy. We are not just cutting out the fee-processing middle man, we

are also eliminating the need for the match-making platform.

Because blockchain

transactions are free,

you can charge minuscule amounts, say 1/100 of a cent for a video view

or article read. Why should I pay The Economist or National Geographic

an annual subscription fee if I can pay per article on Facebook or my

favorite chat app. Again, remember that blockchain transactions carry no

transaction cost. You can charge for anything in any amount without

worrying about third parties cutting into your profits.

Blockchain may make selling recorded

music

profitable again for artists by cutting out music companies and

distributors like Apple or Spotify. The music you buy could even be

encoded in the blockchain itself, making it a cloud archive for any song

purchased. Because the amounts charged can be so small, subscription

and streaming services will become irrelevant.

It goes further.

Ebooks could

be fitted with blockchain code. Instead of Amazon taking a cut, and the

credit card company earning money on the sale, the books would

circulate in encoded form and a successful blockchain transaction would

transfer money to the author and unlock the book. Transfer ALL the money

to the author, not just meager royalties. You could do this on a book

review website like Goodreads, or on your own website. The marketplace

Amazon is then unnecessary. Successful iterations could even include

reviews and other third-party information about the book.

In the

financial

world the applications are more obvious and the revolutionary changes

more imminent. Blockchains will change the way stock exchanges work,

loans are bundled, and insurances contracted. They will eliminate bank

accounts and practically all services offered by banks. Almost

every financial institution will go bankrupt

or be forced to change fundamentally, once the advantages of a safe

ledger without transaction fees is widely understood and implemented.

After all, the financial system is built on taking a small cut of your

money for the privilege of facilitating a transaction. Bankers will

become mere advisers, not gatekeepers of money. Stockbrokers will no

longer be able to earn commissions and the buy/sell spread will

disappear.

How Does Blockchain Work?

Picture

a spreadsheet that is duplicated thousands of times across a network of

computers. Then imagine that this network is designed to regularly

update this spreadsheet and you have a basic understanding of the

blockchain.

Information held on a blockchain exists as a shared —

and continually reconciled — database. This is a way of using the

network that has obvious benefits. The blockchain database isn’t stored

in any single location, meaning the records it keeps are truly public

and easily verifiable. No centralized version of this information exists

for a hacker to corrupt. Hosted by millions of computers

simultaneously, its data is accessible to anyone on the internet.

To go in deeper with the Google spreadsheet analogy, I would like you to read this piece from a blockchain specialist.

“The

traditional way of sharing documents with collaboration is to send a

Microsoft Word document to another recipient, and ask them to make

revisions to it. The problem with that scenario is that you need to wait

until receiving a return copy before you can see or make other changes

because you are locked out of editing it until the other person is done

with it. That’s how databases work today. Two owners can’t be messing

with the same record at once.That’s how banks maintain money balances

and transfers; they briefly lock access (or decrease the balance) while

they make a transfer, then update the other side, then re-open access

(or update again).With Google Docs (or Google Sheets), both parties have

access to the same document at the same time, and the single version of

that document is always visible to both of them. It is like a shared

ledger, but it is a shared document. The distributed part comes into

play when sharing involves a number of people.

Imagine

the number of legal documents that should be used that way. Instead of

passing them to each other, losing track of versions, and not being in

sync with the other version, why can’t *all* business documents become

shared instead of transferred back and forth? So many types of legal

contracts would be ideal for that kind of workflow. You don’t need a

blockchain to share documents, but the shared documents analogy is a

powerful one.” – William Mougayar, Venture advisor, 4x entrepreneur,

marketer, strategist and blockchain specialist

“The

traditional way of sharing documents with collaboration is to send a

Microsoft Word document to another recipient, and ask them to make

revisions to it. The problem with that scenario is that you need to wait

until receiving a return copy before you can see or make other changes

because you are locked out of editing it until the other person is done

with it. That’s how databases work today. Two owners can’t be messing

with the same record at once.That’s how banks maintain money balances

and transfers; they briefly lock access (or decrease the balance) while

they make a transfer, then update the other side, then re-open access

(or update again).With Google Docs (or Google Sheets), both parties have

access to the same document at the same time, and the single version of

that document is always visible to both of them. It is like a shared

ledger, but it is a shared document. The distributed part comes into

play when sharing involves a number of people.

Imagine

the number of legal documents that should be used that way. Instead of

passing them to each other, losing track of versions, and not being in

sync with the other version, why can’t *all* business documents become

shared instead of transferred back and forth? So many types of legal

contracts would be ideal for that kind of workflow. You don’t need a

blockchain to share documents, but the shared documents analogy is a

powerful one.” – William Mougayar, Venture advisor, 4x entrepreneur,

marketer, strategist and blockchain specialist

The reason why the blockchain has gained so much admiration is that:

- It is not owned by a single entity, hence it is decentralized

- The data is cryptographically stored inside

- The blockchain is immutable, so no one can tamper with the data that is inside the blockchain

- The blockchain is transparent so one can track the data if they want to

The Three Pillars of Blockchain Technology

The three main properties of Blockchain Technology which has helped it gain widespread acclaim are as follows:

- Decentralization

- Transparency

- Immutability

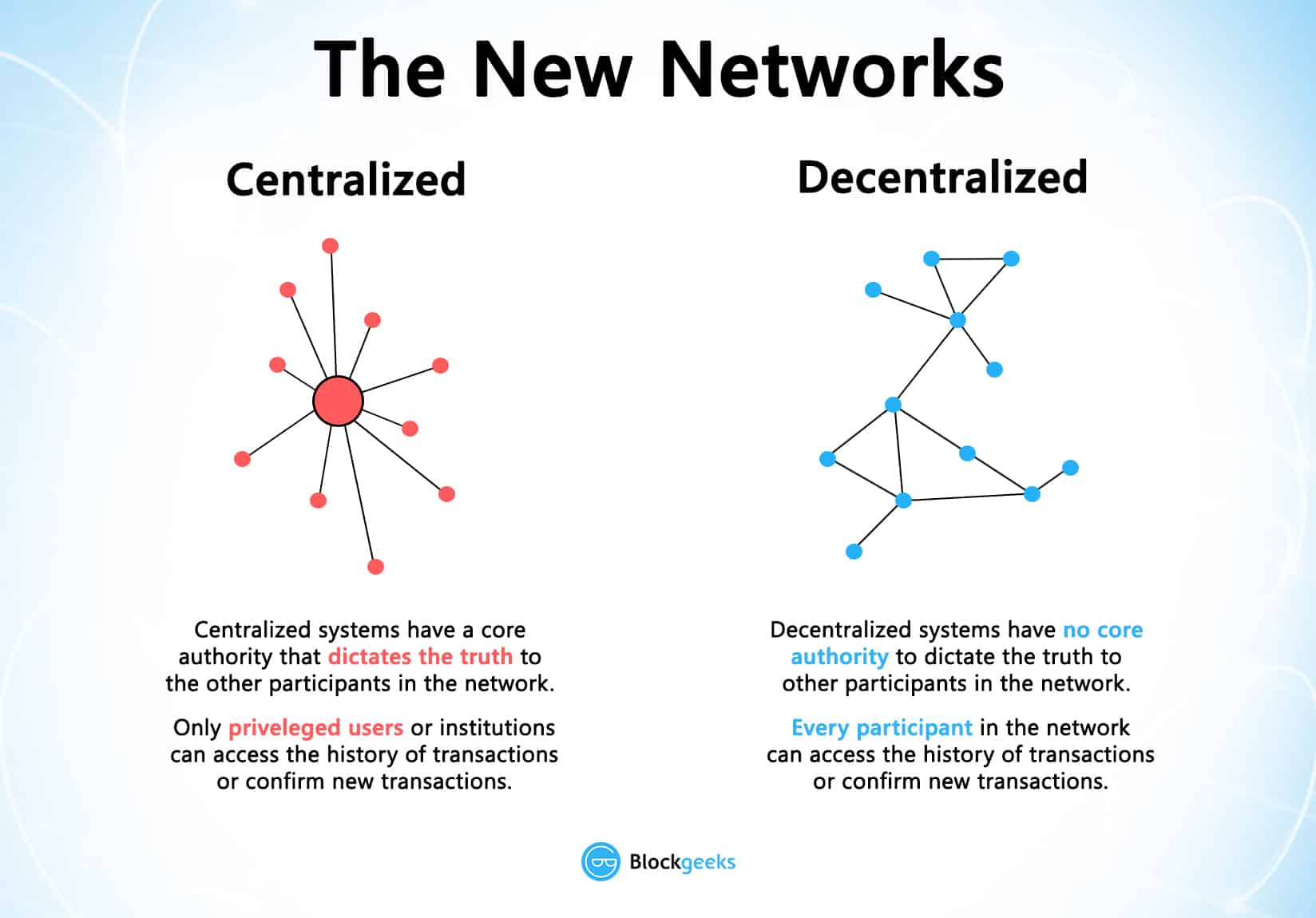

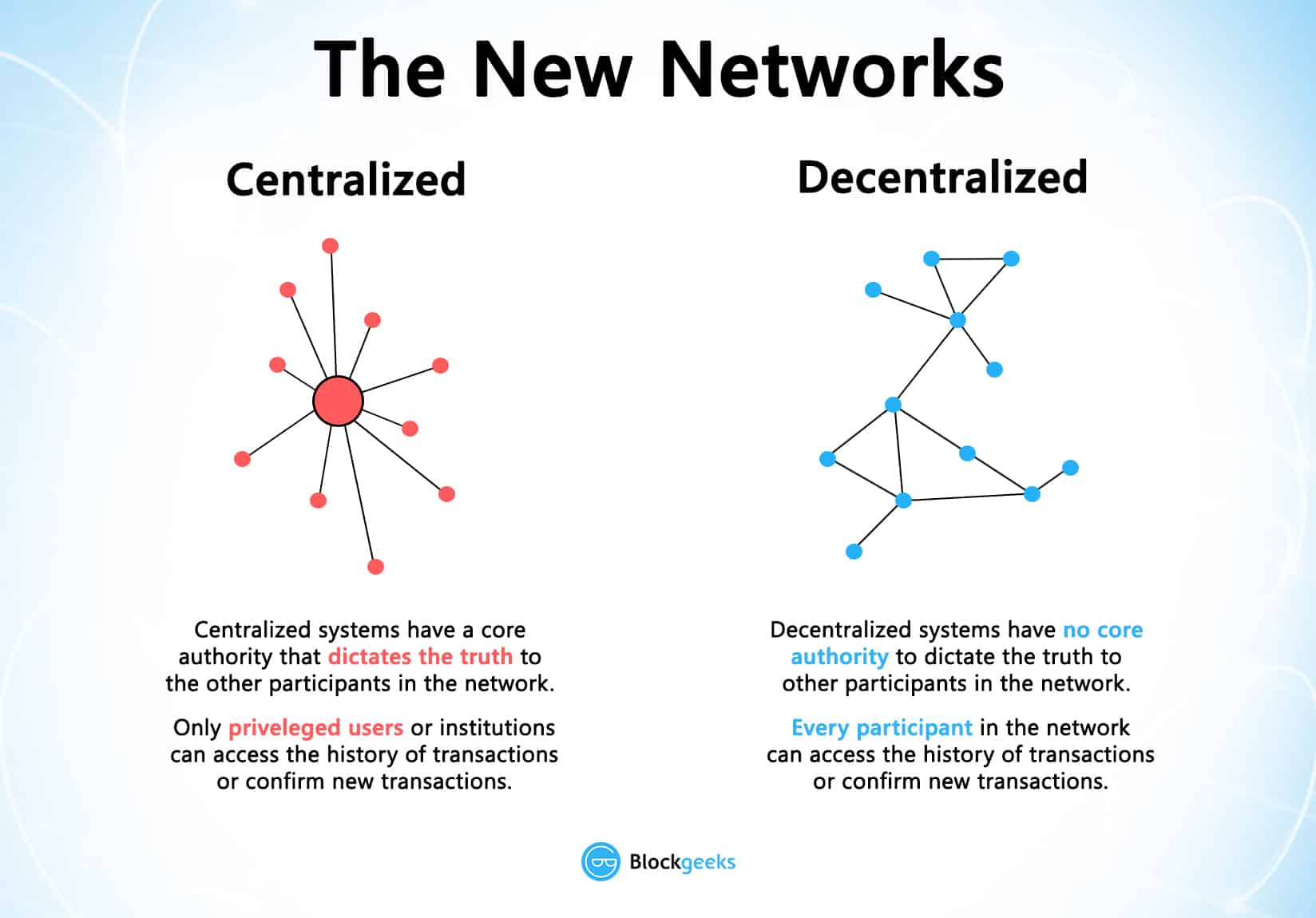

Pillar #1: Decentralization

Before

Bitcoin and BitTorrent came along, we were more used to centralized

services. The idea is very simple. You have a centralized entity which

stored all the data and you’d have to interact solely with this entity

to get whatever information you required.

Another example of a

centralized system is banks. They store all your money, and the only way

that you can pay someone is by going through the bank.

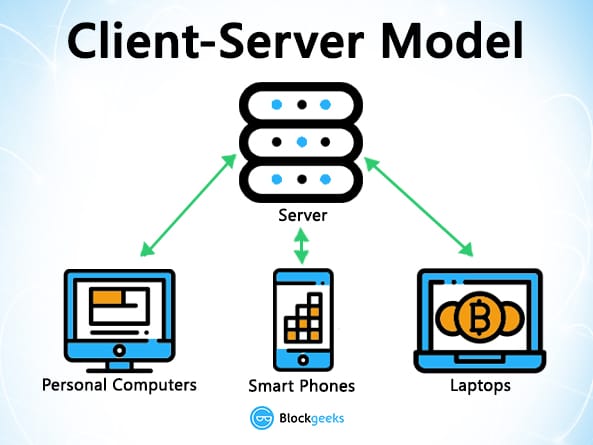

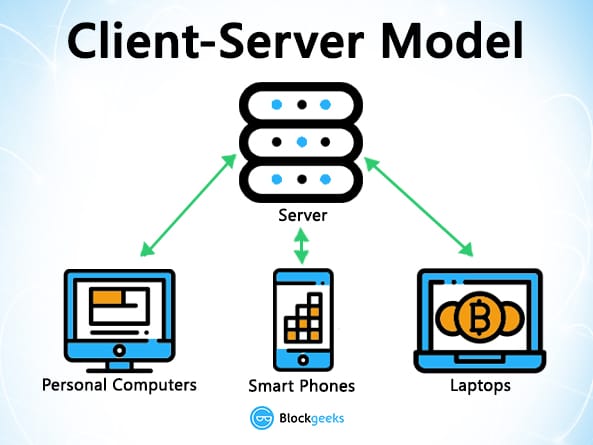

The traditional client-server model is a perfect example of this:

When

you google search for something, you send a query to the server who

then gets back at you with the relevant information. That is simple

client-server.

Now, centralized systems have treated us well for many years, however, they have several vulnerabilities.

- Firstly,

because they are centralized, all the data is stored in one spot. This

makes them easy target spots for potential hackers.

- If the centralized system were to go through a software upgrade, it would halt the entire system

- What

if the centralized entity somehow shut down for whatever reason? That

way nobody will be able to access the information that it possesses

- Worst

case scenario, what if this entity gets corrupted and malicious? If

that happens then all the data that is inside the blockchain will be

compromised.

So, what happens if we just take this centralized entity away?

In

a decentralized system, the information is not stored by one single

entity. In fact, everyone in the network owns the information.

In a

decentralized network, if you wanted to interact with your friend then

you can do so directly without going through a third party. That was the

main ideology behind Bitcoins. You and only you alone are in charge of

your money. You can send your money to anyone you want without having to

go through a bank.

Pillar #2: Transparency

One

of the most interesting and misunderstood concepts in blockchain

technology is “transparency.” Some people say that blockchain gives you

privacy while some say that it is transparent. Why do you think that

happens?

Well… a person’s identity is hidden via complex

cryptography and represented only by their public address. So, if you

were to look up a person’s transaction history, you will not see “Bob

sent 1 BTC” instead you will see “1MF1bhsFLkBzzz9vpFYEmvwT2TbyCt7NZJ

sent 1 BTC”.

The following snapshot of Ethereum transactions will show you what we mean:

So,

while the person’s real identity is secure, you will still see all the

transactions that were done by their public address. This level of

transparency has never existed before within a financial system. It adds

that extra, and much needed, level of accountability which is required

by some of these biggest institutions.

Speaking purely from the point of view of

cryptocurrency,

if you know the public address of one of these big companies, you can

simply pop it in an explorer and look at all the transactions that they

have engaged in. This forces them to be honest, something that they have

never had to deal with before.

However, that’s not the best

use-case. We are pretty sure that most of these companies won’t transact

using cryptocurrencies, and even if they do, they won’t do ALL their

transactions using cryptocurrencies. However, what if the blockchain

technology was integrated…say in their supply chain?

You can see why something like this can be very helpful for the finance industry right?

Pillar #3: Immutability

Immutability,

in the context of the blockchain, means that once something has been

entered into the blockchain, it cannot be tampered with.

Can you imagine how valuable this will be for financial institutes?

Imagine

how many embezzlement cases can be nipped in the bud if people know

that they can’t “work the books” and fiddle around with company

accounts.

The reason why the blockchain gets this property is that of cryptographic hash function.

In

simple terms, hashing means taking an input string of any length and

giving out an output of a fixed length. In the context of

cryptocurrencies like bitcoin, the transactions are taken as an input

and run through a hashing algorithm (bitcoin uses SHA-256) which gives

an output of a fixed length.

Let’s see how the hashing process

works. We are going to put in certain inputs. For this exercise, we are

going to use the SHA-256 (Secure Hashing Algorithm 256).

As

you can see, in the case of SHA-256, no matter how big or small your

input is, the output will always have a fixed 256-bits length. This

becomes critical when you are dealing with a huge amount of data and

transactions. So basically, instead of remembering the input data which

could be huge, you can just remember the hash and keep track.

A

cryptographic hash function is a special class of hash functions which

has various properties making it ideal for cryptography. There are

certain properties that a cryptographic hash function needs to have in

order to be considered secure. You can read about those in detail in our

guide on hashing.

There is just one property that we want you to focus on today. It is called the “Avalanche Effect.”

What does that mean?

Even

if you make a small change in your input, the changes that will be

reflected in the hash will be huge. Let’s test it out using SHA-256:

You

see that? Even though you just changed the case of the first alphabet

of the input, look at how much that has affected the output hash. Now,

let’s go back to our previous point when we were looking at blockchain

architecture. What we said was:

The blockchain is a linked list

which contains data and a hash pointer which points to its previous

block, hence creating the chain. What is a hash pointer? A hash pointer

is similar to a pointer, but instead of just containing the address of

the previous block it also contains the hash of the data inside the

previous block.

This one small tweak is what makes blockchains so amazingly reliable and trailblazing.

Imagine

this for a second, a hacker attacks block 3 and tries to change the

data. Because of the properties of hash functions, a slight change in

data will change the hash drastically. This means that any slight

changes made in block 3, will change the hash which is stored in block

2, now that in turn will change the data and the hash of block 2 which

will result in changes in block 1 and so on and so forth. This will

completely change the chain, which is impossible. This is exactly how

blockchains attain immutability.

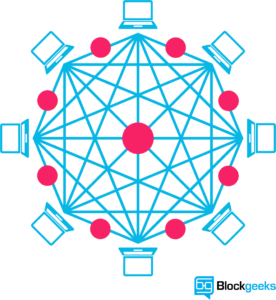

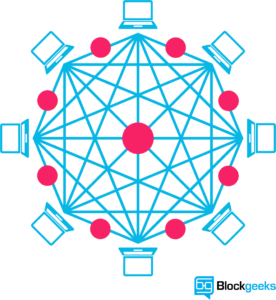

Maintaining the Blockchain – Network and Nodes

The

blockchain is maintained by a peer-to-peer network. The network is a

collection of nodes which are interconnected to one another. Nodes are

individual computers which take in input and performs a function on them

and gives an output. The blockchain uses a special kind of network

called “peer-to-peer network” which partitions its entire workload

between participants, who are all equally privileged, called “peers”.

There is no longer one central server, now there are several distributed

and decentralized peers.

Why do people use the peer-to-peer network?

One

of the main uses of the peer-to-peer network is file sharing, also

called torrenting. If you are to use a client-server model for

downloading, then it is usually extremely slow and entirely dependent on

the health of the server. Plus, like we said, it is prone to

censorship.

However, in a peer-to-peer system, there is no central

authority, and hence if even one of the peers in the network goes out

of the race, you still have more peers to download from. Plus, it is not

subject to the idealistic standards of a central system, hence it is

not prone to censorship.

If we were to compare the two:

Image courtesy: Quora

The

decentralized nature of a peer-to-peer system becomes critical as we

move on to the next section. How critical? Well, the simple (at least on

paper) idea of combining this peer-to-peer network with a payment

system has completely revolutionized the finance industry by giving

birth to cryptocurrency.

The use of networks and nodes in cryptocurrencies.

The

peer-to-peer network structure in cryptocurrencies is structured

according to the consensus mechanism that they are utilizing. For

cryptos like Bitcoin and Ethereum which uses a normal proof-of-work

consensus mechanism (Ethereum will eventually move on to Proof of

Stake), all the nodes have the same privilege. The idea is to create an

egalitarian network. The nodes are not given any special privileges,

however, their functions and degree of participation may differ. There

is no centralized server/entity, nor is there any hierarchy. It is a

flat topology.

These decentralized cryptocurrencies are structured

like that is because of a simple reason, to stay true to their

philosophy. The idea is to have a currency system, where everyone is

treated as an equal and there is no governing body, which can determine

the value of the currency based on a whim. This is true for both bitcoin

and Ethereum.

Now, if there is no central system, how would

everyone in the system get to know that a certain transaction has

happened? The network follows the gossip protocol. Think of how gossip

spreads. Suppose Alice sent 3 ETH to Bob. The nodes nearest to her will

get to know of this, and then they will tell the nodes closest to them,

and then they will tell their neighbors, and this will keep on spreading

out until everyone knows. Nodes are basically your nosy, annoying

relatives.

So, what is a node in the context of Ethereum? A node is simply a

computer that participates in the Ethereum network. This participation

can be in three ways

- By keeping a shallow-copy of the blockchain aka a Light Client

- By keeping a full-copy of the blockchain aka a Full Node

- By verifying the transactions aka Mining

However,

the problem with this design is that it is not really that scalable.

Which is why, a lot of new generation cryptocurrencies adopt a

leader-based consensus mechanism. In EOS, Cardano, Neo etc. the nodes

elect leader nodes or “super nodes” who are in charge of the consensus

and overall network health. These cryptos are a lot faster but they are

not the most decentralized of systems.

So, in a way, cryptos have to make the trade-off between speed and decentralization.

Who Will Use The Blockchain?

As web infrastructure, you don’t need to know about the blockchain for it to be useful in your life.

Currently,

finance offers the strongest use cases for the technology.

International remittances, for instance. The World Bank estimates that

over $430 billion US in money transfers were sent in 2015. And at the

moment there is a high demand for

blockchain developers.

The

blockchain potentially cuts out the middleman for these types of

transactions. Personal computing became accessible to the general public

with the invention of the Graphical User Interface (GUI), which took

the form of a “desktop”. Similarly, the most common GUI devised for the

blockchain are the so-called “wallet” applications, which people use to

buy things with Bitcoin, and store it along with other cryptocurrencies.

Transactions

online are closely connected to the processes of identity verification.

It is easy to imagine that wallet apps will transform in the coming

years to include other types of identity management.

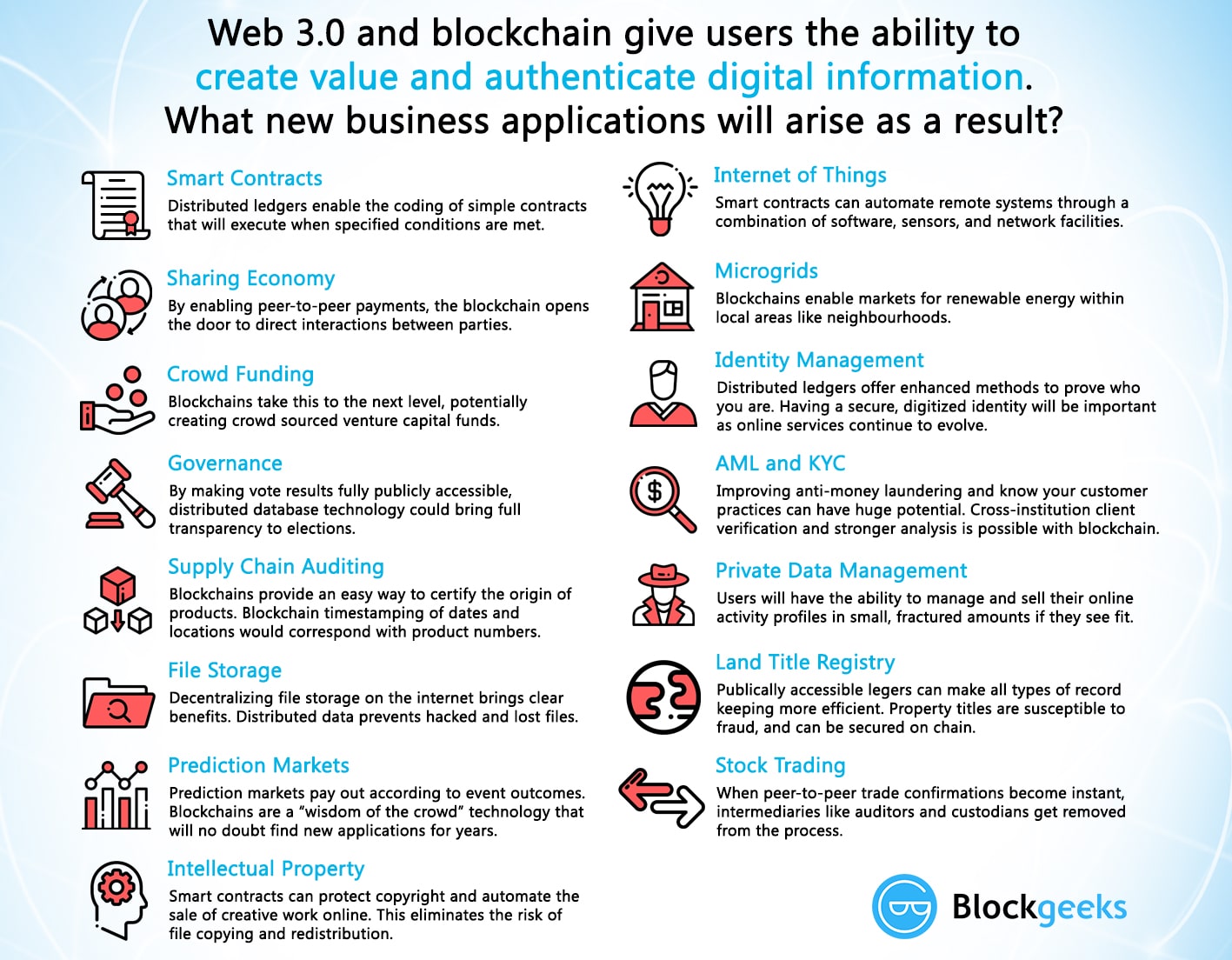

What is Blockchain? And What New Applications Will It Bring Us?

The blockchain gives internet users the ability to create value and authenticates digital information. What new business

applications will result from this?

#1 Smart contracts

Distributed

ledgers enable the coding of simple contracts that will execute when

specified conditions are met. Ethereum is an open source blockchain

project that was built specifically to realize this possibility. Still,

in its early stages, Ethereum has the potential to leverage the

usefulness of blockchains on a truly world-changing scale.

At the

technology’s current level of development, smart contracts can be

programmed to perform simple functions. For instance, a derivative could

be paid out when a financial instrument meets certain benchmark, with

the use of blockchain technology and Bitcoin enabling the payout to be

automated.

#2 The sharing economy

With

companies like Uber and Airbnb flourishing, the sharing economy is

already a proven success. Currently, however, users who want to hail a

ride-sharing service have to rely on an intermediary like Uber. By

enabling peer-to-peer payments, the blockchain opens the door to direct

interaction between parties — a truly decentralized sharing economy

results.

An early example, OpenBazaar uses the blockchain to

create a peer-to-peer eBay. Download the app onto your computing device,

and you can transact with OpenBazzar vendors without paying transaction

fees. The “no rules” ethos of the protocol means that personal

reputation will be even more important to business interactions than it

currently is on eBay.

#3 Crowdfunding

Crowdfunding

initiatives like Kickstarter and Gofundme are doing the advance work

for the emerging peer-to-peer economy. The popularity of these sites

suggests people want to have a direct say in product development.

Blockchains take this interest to the next level, potentially creating

crowd-sourced venture capital funds.

In 2016, one such experiment,

the Ethereum-based DAO (Decentralized Autonomous Organization), raised

an astonishing $200 million USD in just over two months. Participants

purchased “DAO tokens” allowing them to vote on smart contract venture

capital investments (voting power was proportionate to the number of DAO

they were holding). A subsequent hack of project funds proved that the

project was launched without proper due diligence, with disastrous

consequences. Regardless, the DAO experiment suggests the blockchain has

the potential to usher in “a new paradigm of economic cooperation.”

#4 Governance

By

making the results fully transparent and publicly accessible,

distributed database technology could bring full transparency to

elections or any other kind of poll taking. Ethereum-based smart

contracts help to automate the process.

The app, Boardroom,

enables organizational decision-making to happen on the blockchain. In

practice, this means company governance becomes fully transparent and

verifiable when managing digital assets, equity or information.

#5 Supply chain auditing

Consumers

increasingly want to know that the ethical claims companies make about

their products are real. Distributed ledgers provide an easy way to

certify that the backstories of the things we buy are genuine.

Transparency comes with blockchain-based timestamping of a date and

location — on ethical diamonds, for instance — that corresponds to a

product number.

The UK-based Provenance offers supply chain

auditing for a range of consumer goods. Making use of the Ethereum

blockchain, a Provenance pilot project ensures that fish sold in Sushi

restaurants in Japan has been sustainably harvested by its suppliers in

Indonesia.

#6 File storage

Decentralizing

file storage on the internet brings clear benefits. Distributing data

throughout the network protects files from getting hacked or lost.

Inter

Planetary File System (IPFS) makes it easy to conceptualize how a

distributed web might operate. Similar to the way a BitTorrent moves

data around the internet, IPFS gets rid of the need for centralized

client-server relationships (i.e., the current web). An internet made up

of completely decentralized websites has the potential to speed up file

transfer and streaming times. Such an improvement is not only

convenient. It’s a necessary upgrade to the web’s currently overloaded

content-delivery systems.

#7 Prediction markets

The

crowdsourcing of predictions on event probability is proven to have a

high degree of accuracy. Averaging opinions cancels out the unexamined

biases that distort judgment. Prediction markets that payout according

to event outcomes are already active. Blockchains are a “wisdom of the

crowd” technology that will no doubt find other applications in the

years to come.

The prediction market application Augur makes share

offerings on the outcome of real-world events. Participants can earn

money by buying into the correct prediction. The more shares purchased

in the correct outcome, the higher the payout will be. With a small

commitment of funds (less than a dollar), anyone can ask a question,

create a market based on a predicted outcome, and collect half of all

transaction fees the market generates.

#8 Protection of intellectual property

As

is well known, digital information can be infinitely reproduced — and

distributed widely thanks to the internet. This has given web users

globally a goldmine of free content. However, copyright holders have not

been so lucky, losing control over their intellectual property and

suffering financially as a consequence. Smart contracts can protect

copyright and automate the sale of creative works online, eliminating

the risk of file copying and redistribution.

Mycelia uses the

blockchain to create a peer-to-peer music distribution system. Founded

by the UK singer-songwriter Imogen Heap, Mycelia enables musicians to

sell songs directly to audiences, as well as license samples to

producers and divvy up royalties to songwriters and musicians — all of

these functions being automated by smart contracts. The capacity of

blockchains to issue payments in fractional cryptocurrency amounts

(micropayments) suggests this use case for the blockchain has a strong

chance of success.

#9 Internet of Things (IoT)

What

is the IoT? The network-controlled management of certain types of

electronic devices — for instance, the monitoring of air temperature in a

storage facility. Smart contracts make the automation of remote systems

management possible. A combination of software, sensors, and the

network facilitates an exchange of data between objects and mechanisms.

The result increases system efficiency and improves cost monitoring.

The

biggest players in manufacturing, tech and telecommunications are all

vying for IoT dominance. Think Samsung, IBM and AT&T. A natural

extension of existing infrastructure controlled by incumbents, IoT

applications will run the gamut from predictive maintenance of

mechanical parts to data analytics, and mass-scale automated systems

management.

#10 Neighbourhood Microgrids

Blockchain

technology enables the buying and selling of the renewable energy

generated by neighborhood microgrids. When solar panels make excess

energy, Ethereum-based smart contracts automatically redistribute it.

Similar types of smart contract automation will have many other

applications as the IoT becomes a reality.

Located in Brooklyn,

Consensys is one of the foremost companies globally that is developing a

range of applications for Ethereum. One project they are partnering on

is Transactive Grid, working with the distributed energy outfit, LO3. A

prototype project currently up and running uses Ethereum smart contracts

to automate the monitoring and redistribution of microgrid energy. This

so-called “intelligent grid” is an early example of IoT functionality.

#11 Identity management

There

is a definite need for better identity management on the web. The

ability to verify your identity is the lynchpin of financial

transactions that happen online. However, remedies for the security

risks that come with web commerce are imperfect at best. Distributed

ledgers offer enhanced methods for proving who you are, along with the

possibility to digitize personal documents. Having a secure identity

will also be important for online interactions — for instance, in the

sharing economy. A good reputation, after all, is the most important

condition for conducting transactions online.

Developing digital

identity standards is proving to be a highly complex process. Technical

challenges aside, a universal online identity solution requires

cooperation between private entities and government. Add to that the

need to navigate legal systems in different countries and the problem

becomes exponentially difficult. E-Commerce on the internet currently

relies on the SSL certificate (the little green lock) for secure

transactions on the web. Netki is a startup that aspires to create an

SSL standard for the blockchain. Having recently announced a $3.5

million seed round, Netki expects a product launch in early 2017.

#12 AML and KYC

Anti-money

laundering (AML) and know your customer (KYC) practices have a strong

potential for being adapted to the blockchain. Currently, financial

institutions must perform a labour intensive multi-step process for each

new customer. KYC costs could be reduced through cross-institution

client verification, and at the same time increase monitoring and

analysis effectiveness.

Startup Polycoin has an AML/KYC solution

that involves analysing transactions. Those transactions identified as

being suspicious are forwarded on to compliance officers. Another

startup Tradle is developing an application called Trust in Motion

(TiM). Characterized as an “Instagram for KYC”, TiM allows customers to

take a snapshot of key documents (passport, utility bill, etc.). Once

verified by the bank, this data is cryptographically stored on the

blockchain.

#13 Data management

Today, in

exchange for their personal data people can use social media platforms

like Facebook for free. In future, users will have the ability to manage

and sell the data their online activity generates. Because it can be

easily distributed in small fractional amounts, Bitcoin — or something

like it — will most likely be the currency that gets used for this type

of transaction.

The MIT project Enigma understands that user

privacy is the key precondition for creating of a personal data

marketplace. Enigma uses cryptographic techniques to allow individual

data sets to be split between nodes, and at the same time run bulk

computations over the data group as a whole. Fragmenting the data also

makes Enigma scalable (unlike those blockchain solutions where data gets

replicated on every node). A Beta launch is promised within the next

six months.

#14 Land title registration

As

Publicly-accessible ledgers, blockchains can make all kinds of

record-keeping more efficient. Property titles are a case in point. They

tend to be susceptible to fraud, as well as costly and labour intensive

to administer.

A number of countries are undertaking

blockchain-based land registry projects. Honduras was the first

government to announce such an initiative in 2015, although the current

status of that project is unclear. This year, the Republic of Georgia

cemented a deal with the Bitfury Group to develop a blockchain system

for property titles. Reportedly, Hernando de Soto, the high-profile

economist and property rights advocate, will be advising on the project.

Most recently, Sweden announced it was experimenting with a blockchain

application for property titles.

#15 Stock trading

The

potential for added efficiency in share settlement makes a strong use

case for blockchains in stock trading. When executed peer-to-peer, trade

confirmations become almost instantaneous (as opposed to taking three

days for clearance). Potentially, this means intermediaries — such as

the clearing house, auditors and custodians — get removed from the

process.

Numerous stock and commodities exchanges are prototyping

blockchain applications for the services they offer, including the ASX

(Australian Securities Exchange), the Deutsche Börse (Frankfurt’s stock

exchange) and the JPX (Japan Exchange Group). Most high profile because

the acknowledged first mover in the area, is the Nasdaq’s Linq, a

platform for private market trading (typically between pre-IPO startups

and investors). A partnership with the blockchain tech company Chain,

Linq announced the completion of it its first share trade in 2015. More

recently, Nasdaq announced the development of a trial blockchain project

for proxy voting on the Estonian Stock Market.

“

As

revolutionary as it sounds, Blockchain truly is a mechanism to bring

everyone to the highest degree of accountability. No more missed

transactions, human or machine errors, or even an exchange that was not

done with the consent of the parties involved. Above anything else, the

most critical area where Blockchain helps is to guarantee the validity

of a transaction by recording it not only on a main register but a

connected distributed system of registers, all of which are connected

through a secure validation mechanism.” –

Ian Khan, TEDx Speaker | Author | Technology Futurist

“The

blockchain is an incorruptible digital ledger of economic transactions

that can be programmed to record not just financial transactions but

virtually everything of value.” – Don & Alex Tapscott, authors

Blockchain Revolution (2016).

“The

blockchain is an incorruptible digital ledger of economic transactions

that can be programmed to record not just financial transactions but

virtually everything of value.” – Don & Alex Tapscott, authors

Blockchain Revolution (2016).

“The

traditional way of sharing documents with collaboration is to send a

Microsoft Word document to another recipient, and ask them to make

revisions to it. The problem with that scenario is that you need to wait

until receiving a return copy before you can see or make other changes

because you are locked out of editing it until the other person is done

with it. That’s how databases work today. Two owners can’t be messing

with the same record at once.That’s how banks maintain money balances

and transfers; they briefly lock access (or decrease the balance) while

they make a transfer, then update the other side, then re-open access

(or update again).With Google Docs (or Google Sheets), both parties have

access to the same document at the same time, and the single version of

that document is always visible to both of them. It is like a shared

ledger, but it is a shared document. The distributed part comes into

play when sharing involves a number of people.

“The

traditional way of sharing documents with collaboration is to send a

Microsoft Word document to another recipient, and ask them to make

revisions to it. The problem with that scenario is that you need to wait

until receiving a return copy before you can see or make other changes

because you are locked out of editing it until the other person is done

with it. That’s how databases work today. Two owners can’t be messing

with the same record at once.That’s how banks maintain money balances

and transfers; they briefly lock access (or decrease the balance) while

they make a transfer, then update the other side, then re-open access

(or update again).With Google Docs (or Google Sheets), both parties have

access to the same document at the same time, and the single version of

that document is always visible to both of them. It is like a shared

ledger, but it is a shared document. The distributed part comes into

play when sharing involves a number of people.

“As

revolutionary as it sounds, Blockchain truly is a mechanism to bring

everyone to the highest degree of accountability. No more missed

transactions, human or machine errors, or even an exchange that was not

done with the consent of the parties involved. Above anything else, the

most critical area where Blockchain helps is to guarantee the validity

of a transaction by recording it not only on a main register but a

connected distributed system of registers, all of which are connected

through a secure validation mechanism.” –

“As

revolutionary as it sounds, Blockchain truly is a mechanism to bring

everyone to the highest degree of accountability. No more missed

transactions, human or machine errors, or even an exchange that was not

done with the consent of the parties involved. Above anything else, the

most critical area where Blockchain helps is to guarantee the validity

of a transaction by recording it not only on a main register but a

connected distributed system of registers, all of which are connected

through a secure validation mechanism.” –